Consolidating the Commodity Chain: Organic farming and agribusiness in northern California

1996, Development Report No. 11

The California organic food sector has been expanding rapidly, from minuscule sales just ten years ago to $75 to $85 million in 1992, and is estimated to have more than doubled since. This study focuses specifically on the northern California vegetable sector as the fastest growing part of the most significant center of production and consumption in the U.S.

The most significant trend in the organic vegetable sector is toward what has been called “appropriation”—where processes once integral to on-farm production are removed from these sites and reconfigured as new sources of profits. Examples of appropriation include purchasing of inputs like compost in outside markets, post-harvest handling and processing, and vertical integration of markets through grower’s agents, grower-shippers, and processors. Major players minimize their involvement in the riskier on-farm production processes by sub-contracting to more marginal firms.

Contrary to the direct marketing ideology of the organic farming movement, it appears that capital may become more concentrated in the various levels of distribution and processing, mirroring the patterns of the industrialization of conventional agriculture.

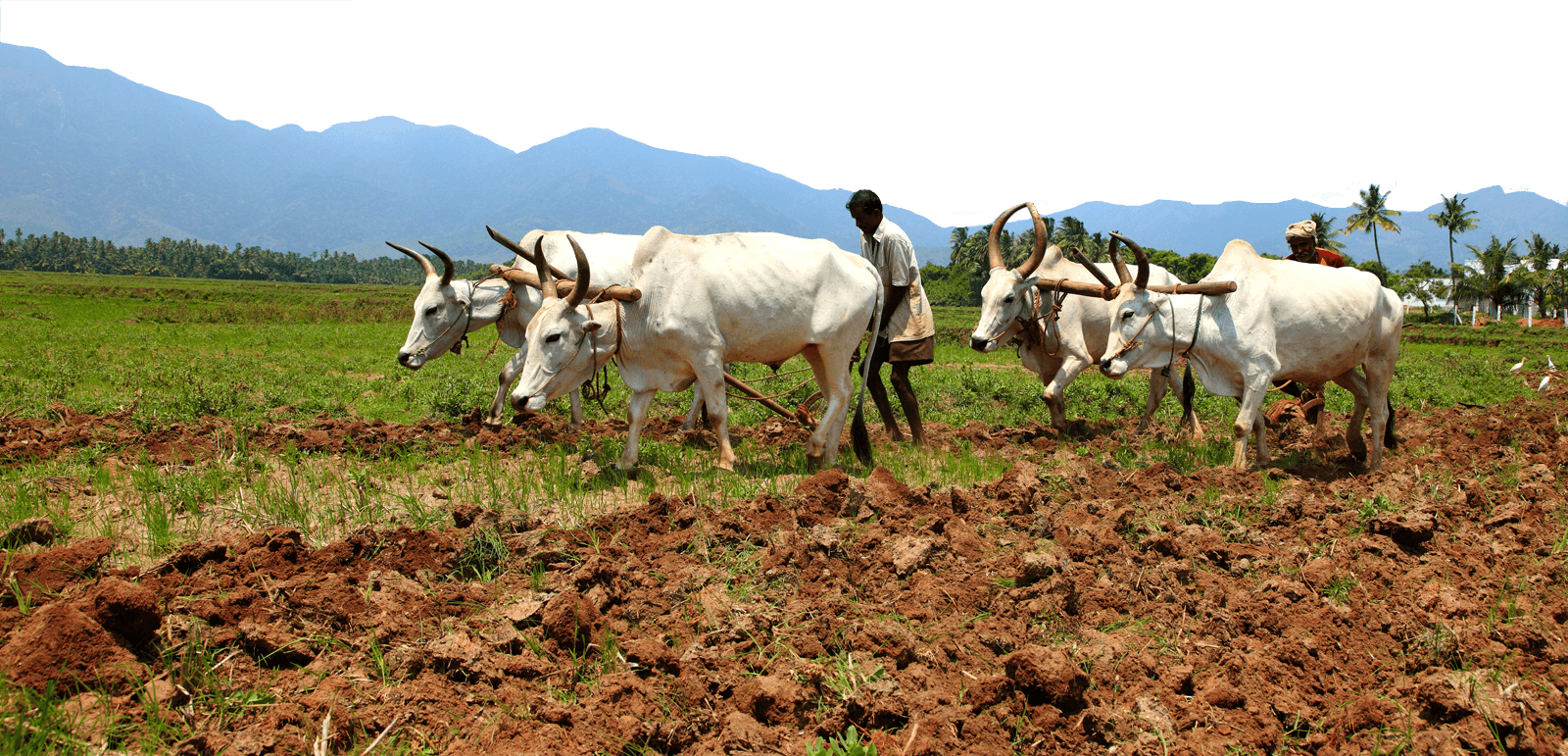

Most production strategies in the industry fall somewhere between two extremes. At one extreme there are still many small, artisan-like farms which tend to be unmechanized, grow many crops simultaneously, engage in year-round crop rotation, and employ a variety of (usually smallscale and local) marketing strategies. At the other extreme are farms which look increasingly like conventional operations. These tend to be larger, mechanized to some degree, and employ cropping patterns typical of California agribusiness (e.g. specializing in one or a few highly profitable crops, seasonal movement of production sites).

Marketing and distribution strategies tend to fall into similar patterns. Small growers, constrained in the conventional market by low production volume, eclectic crop mixes, and inconsistent interest by conventional retail chains, tend to employ direct marketing strategies such as back door sales to restaurants, farmers’ markets, and increasingly, subscription sales. Larger and more capitalized farms are able to employ more traditional distribution strategies, which, in turn means they are able to economize on transportation costs and negotiate higher prices. The consolidation and specialization among organic handlers, the increase in international distribution (despite the ideology of local production for local markets) and the huge growth in organic retail are all signs of such conventionalization.

Several well-known agribusiness firms, attracted by the current high rates of profit and growth, are experimenting with different ways to enter the organic sector, and penetrating some of the most profitable segments of organic vegetable commodity chains. Strategies include entering directly into organic production, handling, or processing through the conversion of existing operations, the addition of new product lines, or the acquisition of organic operations. In spite of these trends, most organic food provision is still characterized by practices and ideologies which countervail tendencies in conventional—and increasingly global—agriculture.

Although there exists no natural, readily apparent, and undisputed definition of the term “organic,” with the gradual development of a regulatory structure, the right to claim that any product is organically produced has become contingent upon compliance with legal, and thus political, definitions. The codification of both the meaning of “organic” and the institutional structure to enforce this definition shape the ways in which agribusiness capital participates in this sector. For example, while the costs of conversion, registration, and certification may act as a barrier to entry, the legal right to market produce as “organic” has also created a brand name of sorts, contributing to premium prices in the marketplace. Also, the regulatory structure, albeit confusing, as built consumer confidence and contributed to overall growth and expansion.

Stay in the loop with Food First!

Get our independent analysis, research, and other publications you care about to your inbox for free!

Sign up today!This study is based on open-ended interviews with seventy players in each link of the various commodity chains, i.e: systems that deliver fresh and processed organic vegetables from farm to table as well as with regulatory agencies and other experts in the field. The purpose of these interviews was to explore recent trends in organic food delivery and particularly, ways in which conventional agribusiness is gaining entry into this lucrative market.

Help Food First to continue growing an informed, transformative, and flourishing food movement.

Help Food First to continue growing an informed, transformative, and flourishing food movement.