Rivers of Finance, But Not a Drop to Drink: Financialization, Power, and Agriculture in California’s Parched Central Valley

This Backgrounder was adapted from Perilous Bounty by Tom Philpott, copyright © 2020. Published by Bloomsbury USA. It has been abridged and lightly edited. Purchase a copy at Bloomsbury.com.

Download the full Backgrounder as a PDF here.

The San Joaquin Valley stands as one of the jewels of US agriculture: a massive producer of fruits, vegetables, wine grapes, and nuts. Like the state of California itself, it came into US possession during a gold rush—and has been shaped by money and power ever since.

When you think of almond farms, the industry would like you to think of independent growers like Joe Del Bosque. I first met Del Bosque in 2014, when I contacted the Almond Board of California for its perspective on the drought. Del Bosque had become a passionate spokesman for the dilemmas independent growers face in a region characterized by a tight labor supply and an even tighter water supply. When we met, he explained how he’d had to fallow hundreds of acres of his prized organic melon fields to divert water to his almond groves, even though the melons require far less water than almonds. But melons are annual crops, so cutting back for a season means a one-time reduction in income; not watering an almond grove could destroy a six-figure investment and a robust multi-year income stream.

Ultimately, farmers like Del Bosque are foot soldiers in California’s nut boom, not its leaders. One firm looms over the boom like a colossal marketing display in a supermarket produce aisle. Owned and operated by the Los Angeles tycoons Stewart and Lynda Resnick, the Wonderful Company calls itself the “world’s largest vertically integrated pistachio and almond grower and processor.”1 Wonderful owns and farms at least fifty thousand acres of nuts in California—more than its closest competitor by a factor of three.

The power couple have flexed their political muscles to make sure their plantations get plenty of water from California’s publicly funded irrigation projects. They store it for dry years in the Kern Water Bank, a man-made, underground reservoir built by the state of California for public water storage. The thirty-two-square-mile reservoir was meant to collect and store excess surface water flowing from the Sierra Nevada during wet years, banking it for urban areas to use in droughts.

In an infamous 1994 deal known as the Monterey Agreement, the Resnicks’ holding company essentially privatized a state-funded water asset designed to be a public good by gaining a controlling stake in the water bank. Ever since, the Kern Water Bank’s liquid dividends have accrued to the Resnicks’ nut groves, while also giving them the option to sell water to cities if that ever proves more profitable than nuts. Meanwhile, the Resnicks ramped up their campaign donations at the federal level, where lawmakers have a say in how much surface water makes it into the Kern bank.

Stay in the loop with Food First!

Get our independent analysis, research, and other publications you care about to your inbox for free!

Sign up today!Their nut dominance puts the Resnicks at the helm of a multi-billion dollar global market. Saudi Arabia wishes it dominated the global oil market the way California does the trade in almonds and pistachios. The state’s farms churn out 80 percent of the world’s almonds,2 the great bulk of them in the San Joaquin Valley.3 Valley farmers are also responsible for more than half the global pistachio output, easily topping their only serious rivals, their counterparts in Iran.4

But there’s a catch: the money can flow only so long as water does. According to the Western Farm Press, a Wonderful exec revealed to a crowd of the company’s nut growers in Visalia, CA, that Wonderful was spending about $6 million per year on a public relations and lobbying effort to keep water deliveries from the big irrigation projects flowing to the valley; and proposed that the industry come together and commit to devoting a fraction of all pistachio sales to the fund, enough to generate an additional $2 million in a typical year.

“Pistachios are valued at 40,000 dollars an acre. How much are you spending in the political arena to preserve that asset?” the exec asked.

The Financialization of Farming

Massive financial interests—banks, pension funds, investment arms of insurance companies—have followed the Resnicks into the nut trade. It’s not hard to see why. Putting in a sizable orchard requires deep pockets.5 Even for a modest two-hundred-acre plot of pistachios, you’re looking at upwards of $500,000 to get in the game—and about $1.2 million for almonds, at $6,200 per acre. Then you have to wait three or four years for the orchard to establish and start churning out a harvestable product.

Once you’re in, though, the rewards are startling: Davis researchers estimate that once an orchard is up and running, almonds can reasonably generate (depending on yield and price) $1,200 per acre annually above production costs, over a life-span of around twenty years.

So a 200-acre almond farm that cost $1.2 million to establish can throw off $240,000 per year in income. The smart money has sized up the situation and decided to pounce. Wall Street’s move into almonds and pistachios is part of a broader trend: the rise of farmland as an “asset class”—finance-speak for a type of investment (e.g., stocks and bonds) that belongs (according to Wall Street salespeople) in every wealthy person’s well-balanced portfolio.

The financialization of farming is pitched as a low-risk way for investors to cash in on two long-term trends. The first is a growing global middle class hungry for high-protein, high-status foods like meat and nuts. The second is the steady shrinkage of arable land under pressure from pollution and urban sprawl. Farmland investments are also largely immune from economic shocks, performing well even when stocks and bonds plunge, boosters note. And they offer investors two potential ways to make money simultaneously: from annual income in the form of either crop sales or rent (if it’s leased to an independent farmer); and from appreciation, assuming the land’s value keeps rising.6

Back in the 1990s, US farmland got what every asset class needs to take flight: an index that financial brokers can brandish to clients. That’s when a group called the National Council of Real Estate Investment Fiduciaries (NCREIF) launched its Farmland Index, which tracks the annual income and appreciation of U.S. agricultural land held by third-party investors.

Values have risen steadily, even when the dot-com bust of the early 2000s and the mortgage meltdown of 2008 tanked stock prices. Overall, between 1992 and 2017, the NCREIF Farmland Index delivered an average annual return of 11.8 percent, beating the S&P’s return of 9.6 percent with much less of the usual stock-market volatility.7

Some states—including Midwestern industrial agriculture titans Iowa, Kansas, Minnesota, and the Dakotas—effectively ban ownership of farmland by financial interests.8 Not California. And the Golden State’s nut boom has been a driving force in the success of the farmland asset class. By late 2018, the NCREIF Farmland Index was tracking $9.4 billion worth of US farm property owned by investors.

In a 2013 note to clients, Heather Davis, then an executive for TIAA (formerly known as TIAA-CREF), a New York–based retirement and investment fund with $1 trillion in total assets under management, made the case for buying San Joaquin Valley farmland and planting nut groves.9 Two “countervailing factors”—surging demand and vanishing land—“make the agricultural sector, including almond farms, an attractive long-term investment theme,” she wrote. Land suitable for almonds in particular, she argued, has the potential to combine the steady income of bonds with the growth potential of stocks—an investor’s holy grail.

TIAA, whose farm assets are now managed by its subsidiary Nuveen, owns 37,000 acres of California farmland, producing “more than 18 million pounds of almonds, enough to circle the world more than nine times or fill the fair territory at Yankee Stadium more than a foot deep,” Davis boasted. Following the Resnicks’ lead, TIAA not only snaps up land for nut groves but also has pursued a “vertical integration” strategy by buying into the processing and marketing side of the business.10

Another financial bigfoot that has invested heavily in this space is the sprawling Canadian insurance and financial services giant Manulife Financial Corporation, through a subsidiary called Hancock Agricultural Investment Group (HAIG). Owning around $3 billion worth of land globally, HAIG calls itself one of the world’s “largest managers of farmland investments for institutional investors”—think pension funds, hedge funds, and university endowments. HAIG owns at least 24,000 acres of almonds, pistachios, and walnuts, making it California’s second-largest nut grower, behind only the Resnicks.11

Then there’s Prudential Financial, the vast insurance and investment conglomerate with assets under management exceeding $1.4 trillion.12 A Prudential subsidiary called PGIM Real Estate Finance owns a farmland portfolio worth $977 million. In late 2018, its website trumpeted two “recent acquisitions:” a pistachio farm in the heart of the San Joaquin Valley that “will provide near term cash flow” to its clients, and an array of land buys in Tulare and surrounding counties that made up a “significant portfolio of well-developed orchards.”

In June 2018, PGIM released a brochure titled Low-Hanging Fruit: Why You Should Plant U.S. Agriculture in Your Institutional Portfolio. Its goal: to entice people to invest in U.S. farmland. Noting that California boasts one of the globe’s five Mediterranean climates, PGIM reminded readers that nuts are mechanically harvested—meaning very low labor costs—and that land planted with permanent crops has delivered an average 14.2 percent annual return over the previous twenty years, trouncing stocks, bonds, the broader real estate market, and timberland, farmland’s

rival as an alternative investment.

The brochure noted that the financialization of the U.S. farm remains “in its nascent stage.”13 Despite its rapid rise as an investment target, just 3 percent of U.S. farmland is owned by institutional capital, the firm reported. But not for long: “an aging farmer generation, fractional family ownership structure, and technological advances requiring sizable capital investment will naturally transition farmland holdings from individuals to institutions.” One topic not mentioned in the pitch: water scarcity in California nut country.

The gusher of institutional cash flowing into the San Joaquin Valley is unlikely to stop anytime soon. In a 2018 report, HAIG took the measure of what it called the “investable universe of farmland”—that is, land not currently owned by investment firms but ripe for the plucking. The group scanned the globe for “core investment geographies that offer a relatively secure business environment” and “the necessary scale for institutional farm management.” The group identified 570,000 acres of San Joaquin Valley land suitable for almond investments, and another 50,000 acres for pistachios.14

Again, just a few years after an epochal drought and amid mounting research showing that San Joaquin Valley agriculture is far overstepping its water limits, the topic of water availability is missing from the report.

As of late 2019, almond and pistachio plantations were still expanding at a steady clip, with no sign of slowing over water-availability concerns. The ongoing influx of Big Capital into the valley is a signal that Wall Street thinks that well-capitalized and well-connected nut and wine operations can keep the water flowing even as the Sierra Nevada snowpack declines, the valley floor sinks, aquifers empty, and water gets scarcer and more poisonous for residents. A bet, in short, that as water grows more scarce, its tendency to flow towards money only increases. While people making these wagers might be acting rationally in terms of their own financial interests—squeeze as much profit out of the land while the getting’s still good—the number-one source of US fruits and vegetables faces severe pressure. As Joe Del Bosque’s story shows, dwindling water means ever more emphasis on pricey export-oriented snack crops—and less on fruit and vegetable crops. And if climate models about the future of California weather hold true, mega-droughts and mega-floods will add severe chaos to this race to the bottom of the aquifer.

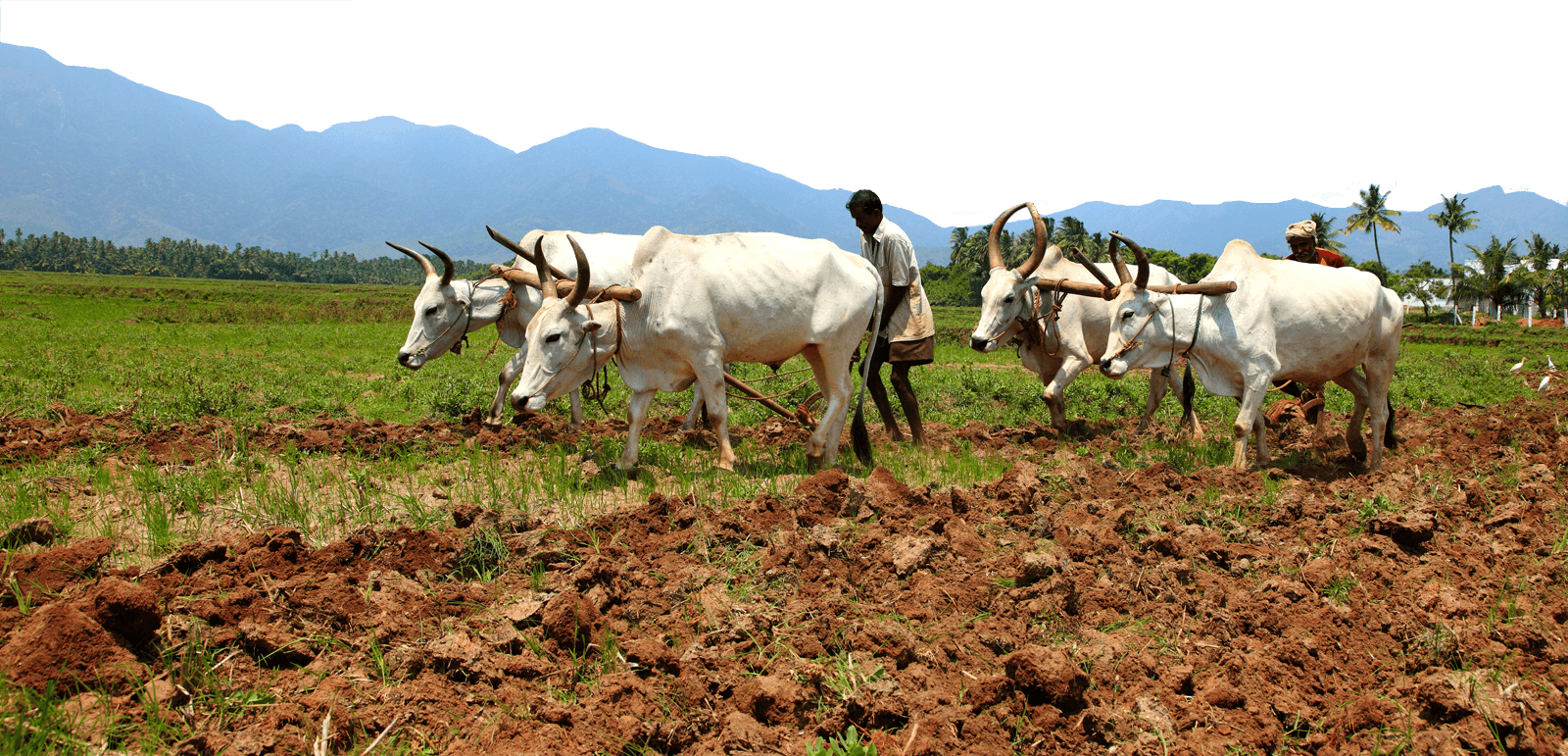

Cover photo: California’s San Joaquin Valley. Photo by Don Graham (CC BY-SA).

- Wonderful Company Wonderful Pistachios, “Press and Trade,” accessed November 13, 2018, https://www.getcrackin.com/press.html.

- “Paramount Citrus Replaces Cuties Brand with Wonderful Halos,” The Packer June 10, 2013, accessed November 14, 2018, https://www.thepacker.com/article /paramount-citrus-replaces-cuties-brand-wonderful-halos

- Ashley Bloemhof, “California Almonds: USDA Estimates Record-Breaking 2018 Crop,” AgFax, July 5, 2018, accessed November 13, 2018, https://agfax .com/2018/07/05/california-almonds-usda-estimates-record-breaking-2018-crop.

- Almond Industry Maps, Almond Board of California, accessed November 14, 2018, http://www.almonds.com/processors/resources/crop-forecast /almond-industry-maps.

- Dennis Pollock, “Paramount Farms Touts Record Pistachio Return, Future,” Western Farm Press, March 16, 2015, accessed November 14, 2018, https:// www.westernfarmpress.com/tree-nuts/paramount-farms-touts-record-pistachio-return-future.

- 2016 Sample Costs to Establish an Orchard and Produce: Almonds, UC Cooperative Extension, accessed November 27, 2018, https://coststudyfiles.ucdavis.edu/uploads /cs_public/87/3c/873c1216-f21e-4e3e-8961-8ece2d647329/2016_almondsjv_south_final _10142016.pdf; and 2015 Sample Costs to Establish and Produce Pistachios, UC Cooperative Extension, accessed November 10, 2018, https://coststudyfiles.ucdavis.edu/uploads/cs_public/50 /a8/50a8805e-03a8-4092-82ca-ce18cfb92b2b/2015pistachios_san_joaquin_valley-south_oct29 .pdf.

- “How does direct investment in global farmland provide diversification, inflation protection, and return potential?,” Nuveen, 2019, https://www .nuveen.com/en-us/thinking/alternatives/investing-in-farmland

- “Low-Hanging Fruit: Why You Should Plant U.S. Agriculture in Your Institutional Portfolio,” PGIM Real Estate Finance, accessed November 27, 2018, http://www.pgimref.com /real-estate-finance/pdf/ag/Charticle_PAI_Booklet_v2_.pdf.

- “Farmland Property Index,” NCREIF, accessed November 26, 2018, https://www.ncreif.org/data-products/farmland.

- “Yankee Stadium” Heather Davis, “Almonds: Harvesting Value Beyond the Farm,” TIAA-CREF, August 7, 2013, https://www.tiaa.org/public/pdf/C11815 _AlmondHarvest.pdf.

- Board of Governors of the Federal Reserve System, Annual Report of Holding Companies, TIAA-CREF, 2016, https://www.documentcloud.org/documents /5301983-Tiaa-Board-of-Overseers-3792687-2016-1.html.

- Hancock Agricultural Investment Group Company Overview, 2018, https://www.documentcloud.org/documents/5237453-HAIG-Q318- Final-1.html

- “Agriculture Equity Investments—PGIM Real Estate Finance,” November27, 2018, http://www.pgimref.com/real-estate-finance/businesses-agricultural-equity-investments.shtml.

- “Gladstone Land Corporation: Major Holders” Yahoo! Finance, accessed November 28, 2018, https://finance.yahoo.com/quote/LAND/holders?p=LAND.

Help Food First to continue growing an informed, transformative, and flourishing food movement.

Help Food First to continue growing an informed, transformative, and flourishing food movement.